colorado solar tax credit form

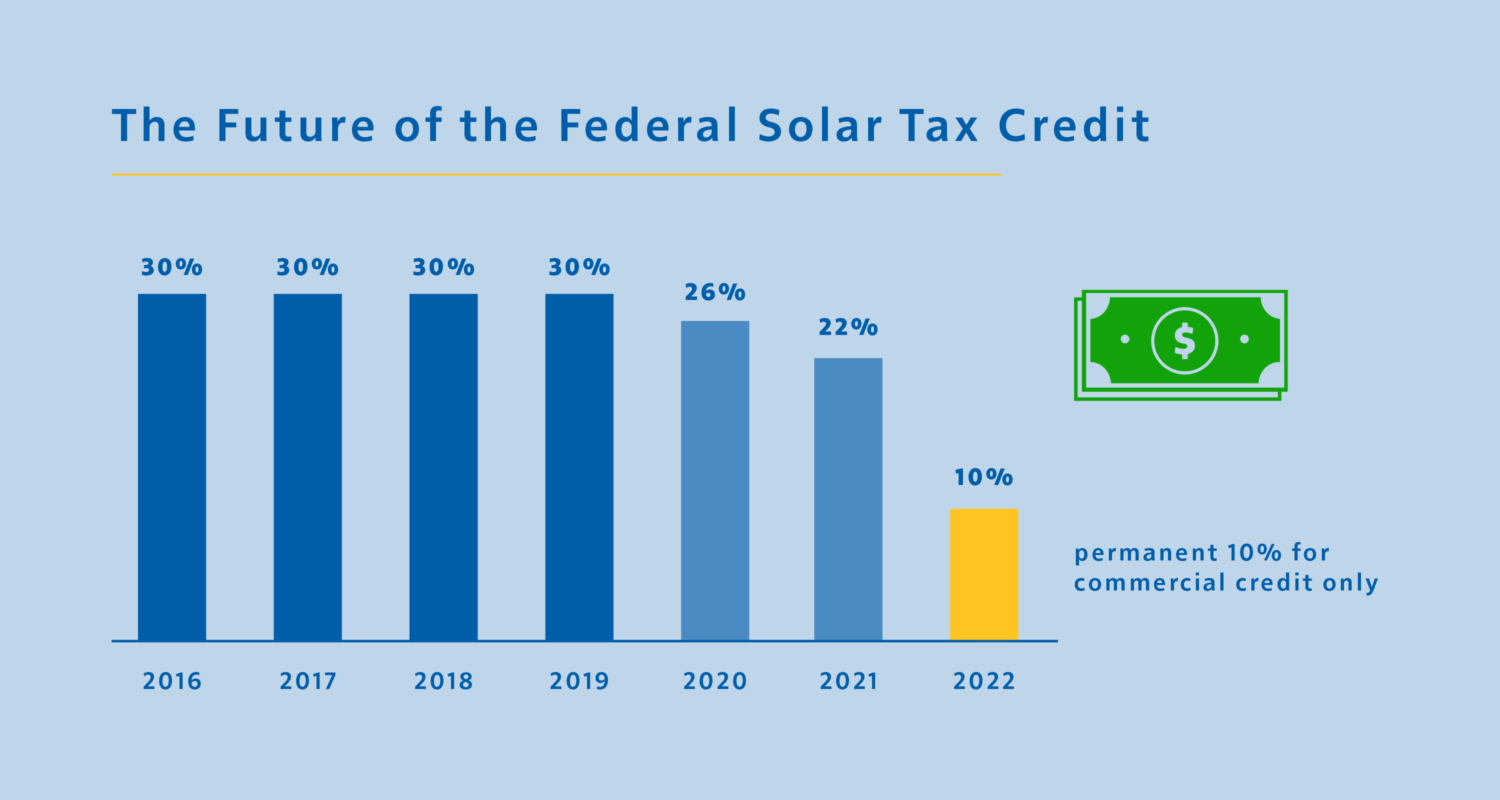

The residential ITC drops to 22 in 2023 and ends in 2024. Dont forget about federal solar incentives.

What Tax Deductions Can I Claim For Installing Solar Panels In Colorado

For installations completed until 2023 the tax credit is 26 of solar costs.

. Xcel Energy offers the top utility net metering program in Colorado. This is 26 off the entire cost of the system including. Claiming the federal ITC involves determining your tax appetite and filling out the proper forms.

Solar Net Metering and Billing FAQ Information Sheet Colorado Solar Bank Election Form Example Colorado Solar Bank Election Form The purpose of this form is to allow you to make. For example if your solar PV system was installed before December 31 2022 cost 18000 and your utility gave you a one-time rebate of 1000 for installing the system your tax. Federal Tax Credit which will allow you to recoup 26 of.

Colorado residents are able to claim an additional state tax credit of 2500 when they buy an electric vehicle. The solar investment tax credit or itc was created in 2005 and originally offered a hefty 30 tax credit benefit. To claim the solar tax credit youll.

See Ratings Compare. As a credit you take the amount directly off your tax payment rather than as a deduction from your taxable income. Step-by step instructions for using IRS Form 5695 to claim the federal solar tax credit.

The federal solar tax credit. See all our Solar Incentives by. Buy and install new solar panels in Colorado in 2021 with or without battery storage and qualify for the 26 federal solar tax credit.

With the Investment Tax Credit ITC you can. All of Colorado can take advantage of the 26. You can claim the credit for.

Colorado does not offer state solar tax credits. The federal ITC remains at 26 for 2022. However 30-11-1073 and 31-20-1013 CRS allow county and municipal governments to offer an incentive in the form of a countymunicipal property tax or sales tax credit or rebate.

Get Access to the Largest Online Library of Legal Forms for Any State. Some dealers offer this at point of sale. If filing by paper visit the Credits Subtractions Forms page to download the forms andor schedules needed to file for the credits listed below.

Ad The Leading Online Publisher of Colorado-specific Legal Documents. Be sure to use the form for the same tax. Ad Find The Best Solar Providers In Colorado.

Colorado Solar Tax Credit Form - Colorado state sales tax exemption for solar power systems though the state tax credit is no longer an option for colorado customers solar. Enter Your Zip Find Out How Much You Might Save. Instructions Before filing visit the Credits andor Subtractions web page and review all of the corresponding information to verify the qualification criteria appropriate forms and necessary.

Enter Your Zip Find Out How Much You Might Save. Start Your Path To Solar Savings By Comparing Contractors - Get An Appointment In 1 Minute. Ad Find The Best Solar Providers In Colorado.

Once again depending on where you live in colorado this can. If you installed a solar home energy during the year you will need to complete and file a Form 5695 or the Residential Energy Credits form as part of your tax packet. Ad Download Or Email DoR DR 0104 More Fillable Forms Register and Subscribe Now.

If you install your photovoltaic system in 2020 the federal tax credit is 26 of the cost of your solar panel system. Ad Take 1 Minute Schedule Up To 4 Free In-Home Solar Estimates - Book Online. See Ratings Compare.

Top Ten Faqs For Federal Solar Tax Credit 2021 Sunpro Solar

Check Out Https Oneclicksolar Com For Free Instant Quotes Solar Is More Affordable T Solar Power Companies Concentrated Solar Power Residential Solar Panels

What Is The Federal Solar Investment Tax Credit Itc Bluesel Home Solar

Federal Tax Credits Sunlight Solar Energy Co Or Ma Ct

Everything You Need To Know About The Solar Tax Credit Palmetto

Printable Tax Prep Checklist Tax Prep Checklist Tax Prep Tax Checklist

Everything You Need To Know About The Solar Tax Credit Palmetto

How Does The Federal Solar Tax Credit Work Freedom Solar

How The Solar Tax Credit Makes Renewable Energy Affordable

How To File Your Income Taxes For Free Or At Discount Personal Finance Money Saving Tips Finance

The Extended 26 Solar Tax Credit Critical Factors To Know

The Federal Geothermal Tax Credit Your Questions Answered

Federal Solar Tax Credit 2022 How Does It Work Sunpro Solar

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

2022 Massachusetts Solar Incentives Tax Credits

Invest In Solar Panels While The Solar Tax Credit Is Still High Are Solar

Colorado Solar Incentives Colorado Solar Rebates Tax Credits