child tax credit september 2021 delay

To receive the full credit parents filing their tax returns as a couple must make no more than 150000. TAXPAYERS who are still waiting for their child tax credits to post could see the payments delayed for a handful of reasons most of which can be determined by a quick look.

The 2021 Child Tax Credit Implications For Health Health Affairs

HUNDREDS of parents across the United States are feeling frustrated with Septembers child tax credit as more than 30million families were expecting to receive the.

. The next payments will be sent out on October 15 November 15 and. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. November 1 for the.

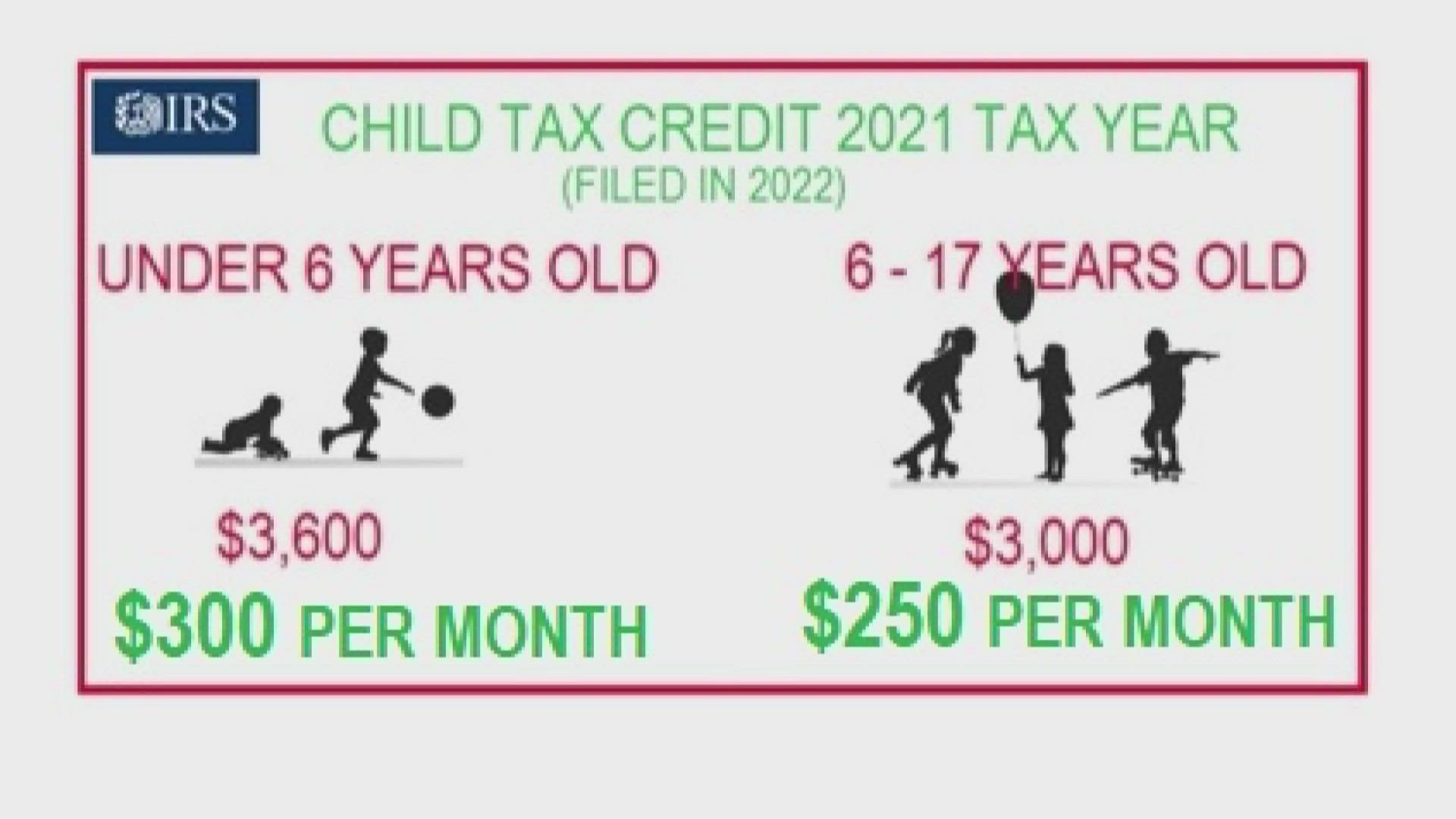

Eligible families can receive a total of up to 3600 for each child under 6 and up to 3000 for each one age 6 to 17 for 2021. Eligible families will receive up to 3600 for each child under the age of 6 and a. Future payments are scheduled for November 15 and.

FAMILIES who are claiming child tax credits may have to wait longer for a tax refund than they expect. Under the American Rescue Plan most eligible families received payments dated July 15 August 13 and September 15. This months is late.

However families can still opt out for the final three checks by un-enrolling via the Child Tax Credit Update Portal by these dates. That depends on your household income and family size. Septembers payments are late heres why.

Child tax credits are sent to families around the 15th of every month unless there is some other issue. Parents in September will receive up to 300 for each child five and under and 250 per kid six to 17. However many families are still waiting for the payment that was due on September 15.

But delay worried some parents who had previously received payments as scheduled in July and August but said they didnt get the September 15 installment as expected. Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet Late Child Tax Credit Payments From Irs Arriving Now Fingerlakes1 Com Child Tax Credit. The Child Tax Credit has been expanded from 2000 per child annually up to as much as 3600 per child.

The expanded child tax credit pays up to 300 per child ages 5 and. CNBC Make It reached out to the IRS earlier this week about reported payment delays and an agency spokesperson said there was no indication of widespread issues with Septembers payments. 150000 if you are married and filing a joint return or if you are filing as a qualifying widow or widower.

October 4 for the October 15 payment. The payments go out 15 September and when the money will be available. After the July and August payments the first two in the special 2021 child tax credit.

112500 if you are filing as a head of household. September 17 2021 This week the IRS successfully delivered a third monthly round of approximately 35 million Child Tax Credits with a total value of about 15 billion. In 2021 the child tax credits were temporarily boosted to 3600 from.

We know people depend on receiving these payments on time and we apologize for the delay the IRS said. Families who did not get a July or August payment and are getting their first monthly payment in September will still receive their total advance payment for the year of up to 1800. The first half of the credit is being delivered in monthly direct deposits from July through December of 300 for children under 6 and 250 for those aged 6 to 17.

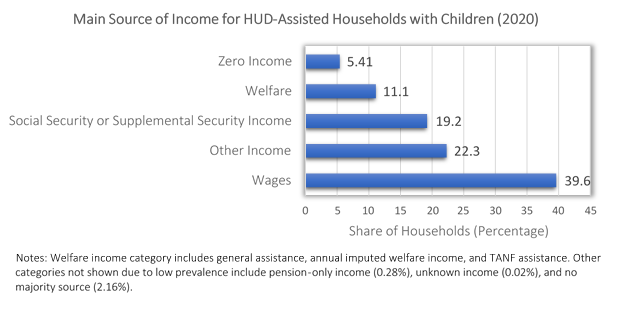

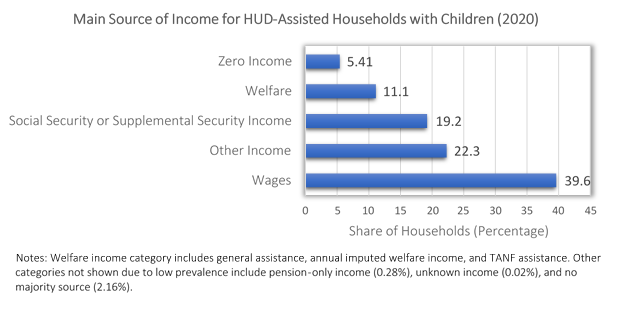

The Advance Child Tax Credit An Opportunity For Hud Assisted Families With Children Hud User

Child Tax Credit Did Not Come Today Issue Delaying Some Payments Kare11 Com

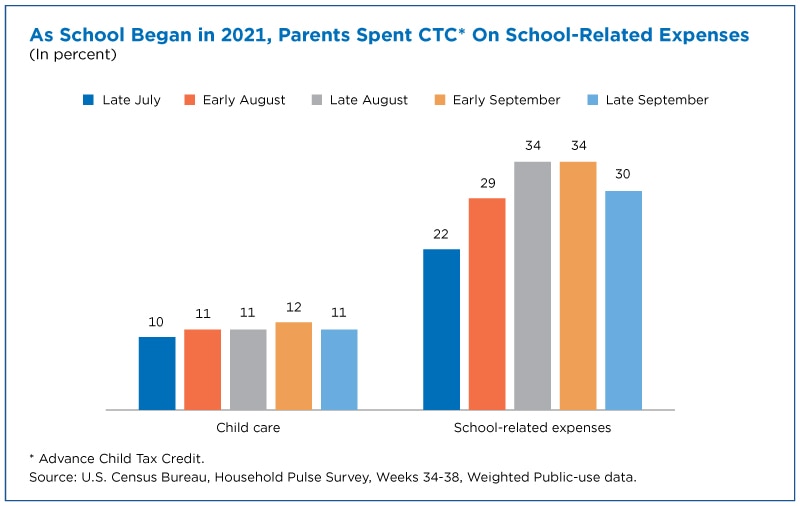

Nearly A Third Of Parents Spent Child Tax Credit On School Expenses

Child Tax Credit 2021 2022 What To Know This Year And How To Claim Your Refund Wsj

Child Tax Credit Portal Glitch Delayed Some September Payments Don T Mess With Taxes

Child Tax Credit August 2021 Payments How To Track Your 300 Check 4 Reasons It S Delayed Itech Post

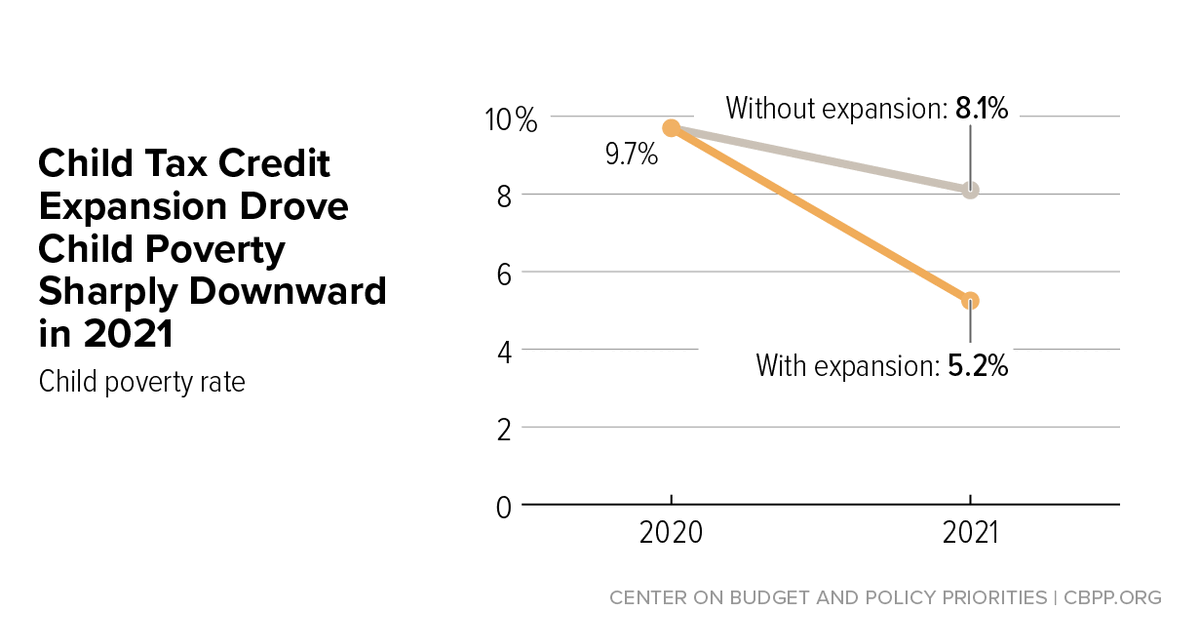

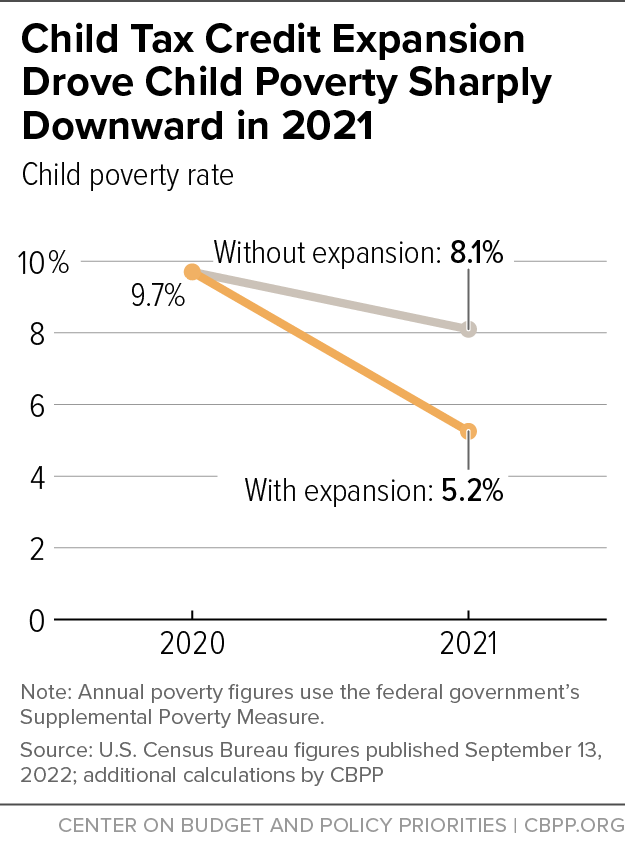

Policymakers Should Expand Child Tax Credit In Year End Legislation To Fight Child Poverty Center On Budget And Policy Priorities

Child Tax Credit Updates Why Are Your October Payments Delayed Marca

Child Tax Credit Irs Unveils New Feature To Help Avoid Mailing Delays Wjhl Tri Cities News Weather

What S New About The Child Tax Credit In 2021 Get It Back

How To Claim The Child Tax Credit For A Baby Born In 2021 Goodrx

The Advance Child Tax Credit An Opportunity For Hud Assisted Families With Children Hud User

Child Tax Credit Did Not Come Today Issue Delaying Some Payments Kare11 Com

Policymakers Should Expand Child Tax Credit In Year End Legislation To Fight Child Poverty Center On Budget And Policy Priorities

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Irs Delays Some September Child Tax Credit Payments Until Oct Wfmynews2 Com

2021 Child Tax Credit Advanced Payment Option Tas

Child Tax Credit Update Third Monthly Payment On September 15 Marca

Tax Season 2022 What To Know About Child Credit And Stimulus Payments The New York Times